By MICHELLE KHOR

Are you the owner of a small business that often deals with larger businesses? Does your business often enter into standard form contracts with these larger businesses, but you believe that the terms of those contracts are unfair to your business?

What’s happening

On 12 November 2016, the Treasury Legislation Amendment (Small Business and Unfair Contract Terms) Act 2015 will amend the Australian Consumer Law[i] (the Acl) and the ASIC Act[ii] (the ASIC Act) to extend unfair contract provisions to small business contracts.

This means that the ACL and the ASIC Act will extend its ambit to govern both company-individual contracts and certain company-company contracts.

What the ASIC Act and the ACL govern

The ASIC Act and the ACL currently contain mirror consumer unfair contract term protections. The ASIC Act’s requirements apply to financial services and products and the ACL applies to the supply of goods or services other than financial services or products and the sale or grant of an interest in land.

Effects of the amendments for small businesses

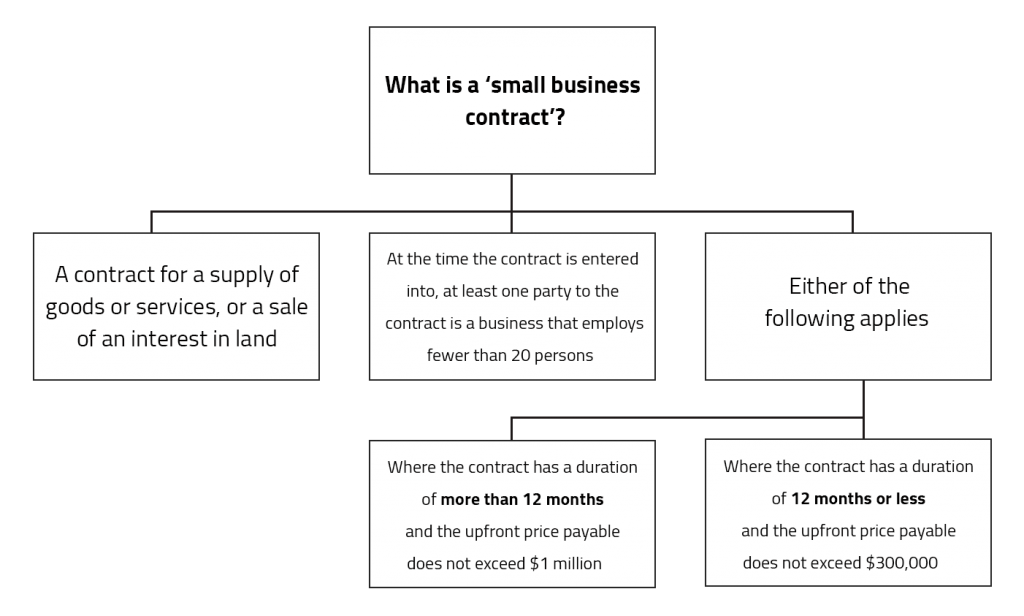

A term of a ‘small business contract’ will be void if it is declared to be unfair, and the contract is a standard form contract.[iii]

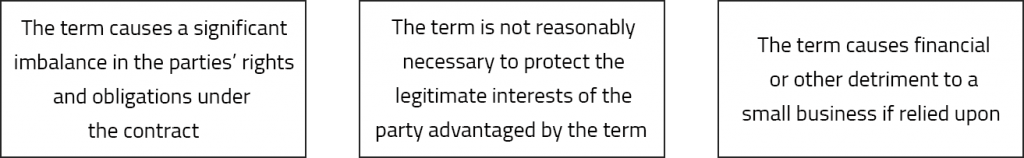

For a small business, a term in a standard form contract is unfair only if:

In determining whether a term is unfair, a court may take into account such matters as it thinks relevant, but must take into account:

- The extent to which the term is transparent, and

- The contract as a whole.[iv]

A term is transparent if the term is:

- Expressed in reasonably plain language,

- Legible,

- Presented clearly, and

- Readily available to any party affected by them.[v]

The party that advantages from the potentially unfair term must also prove that the term is reasonably necessary to protect its legitimate interests.[vi]

When does a contract qualify as a ‘standard form contract’?

There are matters that a court must take into account in determining whether a contract is a standard form contract:

- Whether one of the parties has all or most of the bargaining power relating to the transaction,

- Whether the contract was prepared by one party before any discussion relating to the transaction occurred between the parties,

- Whether another party was, in effect, required either to accept or reject the terms of the contract,

- Whether another party was given an effective opportunity to renegotiate the terms of the contract,

- Whether the terms of the contract take into account the specific characteristics of another party or the particular transaction, and

- Any other matter prescribed by the regulations.[vii]

Examples of unfair contract terms [viii]

An unfair contract term can look like this:

- A term that permits, or has the effect of permitting, one party (but not another party) to avoid or limit performance of the contract

- A term that penalises, or has the effect of penalising, one party (but not another party) for breach or termination of the contract

- A term that permits, or has the effect of permitting, one party (but not another party) to vary the terms of the contract

- A term that permits, or has the effect of permitting, one party (but not another party) to renew or not renew the contract

- A term that permits, or has the effect of permitting, one party (but not another party) to vary the upfront price payable under the contract without the right of another party to terminate the contract

- A term that permits, or has the effect of permitting, one party unilaterally to vary the characteristics of the goods or services to be supplied, or the interest in land to be sold or granted, under the contract

- A term that permits, or has the effect of permitting, one party unilaterally to determine whether the contract has been breached or to interpret its meaning

- A term that limits, or has the effect of limiting, one party’s right to sue another party

What kinds of small business contracts are affected by the amendments

These amendments broadly apply to small business contracts entered into on or after 12 November 2016.

However, if an existing contract:

- Is renewed on or after 12 November 2016 – the amendments apply to that contract, on or from the day (the renewal day) on which the renewal takes effect, in relation to conduct that occurs on or after the renewal day; or

- Is varied on or after 12 November 2016 – the amendments apply to the term as varied, on or from the date (the variation day) on which the variation takes effect, in relation to conduct that occurs on and after the variation day.

Terms and contracts not protected under the unfair contract terms provisions

There are a number of terms and contracts that are expressly excluded from the unfair contract provisions under the ACL and the ASIC Act.

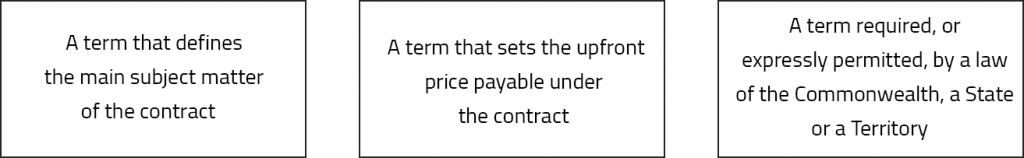

Those terms include:

The upfront price payable for a small business contract is the consideration that:

- is provided for the supply, sale or grant under the contract; and

- is disclosed at or before the time the contract is entered into,

but does not include any other consideration that is contingent on the occurrence or non-occurrence of a particular event.[ix]

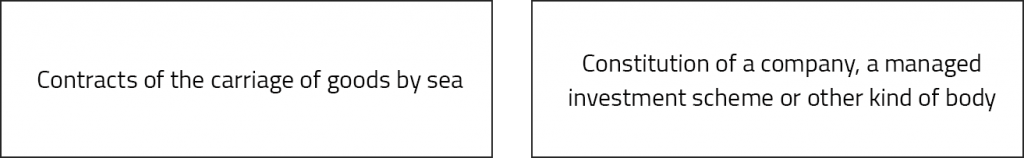

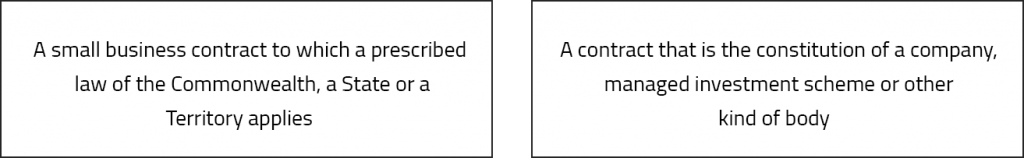

Unfair contract terms provisions also do not apply to:

- For contracts relating to financial products or financial services –

- For contracts relating to goods and services other than financial products or financial services and sale or grant of interest in land –

What this means for small businesses

If you have a business that employs fewer than 20 people, you should:

- Seek legal advice from an experienced commercial lawyer or business lawyer about standard form contracts that your business will be entering into on or after 12 November 2016

- Seek legal advice from an experienced commercial lawyer or business lawyer about standard form contracts that are due for renewal or variation on or after 12 November 2016

- Before seeking to vary certain terms in standard form contracts that are currently on foot, seek legal advice from an experienced commercial lawyer or business lawyer about the terms that are to be varied and have that commercial lawyer or business lawyer negotiate with the other party about those terms

If you have a business that frequently enters into standard form contracts with an upfront price payable not exceeding $300,000, or standard form contracts that are for a duration of more than 12 months and an upfront price payable not exceeding $1 million, you should:

- Seek legal advice from an experienced commercial lawyer or business lawyer about your standard form contracts that are up for renewal on or after 12 November 2016

- Have an experienced commercial lawyer or business lawyer assist in negotiating with small businesses about the variation of certain contract terms under your standard form contracts

- Have an experienced commercial lawyer or business lawyer review your various standard form contracts that you will be using on or after 12 November 2016 to ensure that those standard form contracts do not contradict the unfair contract terms provisions under the ACL and the ASIC Act

If you believe that your business will be affected by the upcoming amendments to the unfair contract terms provisions and is in need of legal advice, Eales & Mackenzie’s team of experienced commercial lawyers and business lawyers can assist you and your business.

For more information, please contact Eales & Mackenzie Commercial Lawyers Melbourne on (03) 8621 1000 or by email advisors@emlawyers.com.au.

The contents of this publication, current at the date of the publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

[i] Competition and Consumer Act 2010 (Cth) Sch 2, Pt 2-3 [ii] Australian Securities and Investments Commission Act 2001 (Cth) Pt 2, Div 2, Sub-div BA [iii] ACL s 23 [iv] ACL s 24(2) [v] ACL s 24(3) [vi] ACL s 24(4) [vii] ACL s 27 [viii] ACL s 25; ASIC Act s 12BH [ix] ACL s 26